Olive Oil prices in 2025 – the reasons why the olive oil prices dropped

What are the olive oil prices in 2025? Why the cost to buy Extra Virgin Olive Oil is almost halved this year in some countries?

European Olive Oil Market Trends: What to Expect in 2025

The European olive oil industry is set for a pivotal year in 2025, shaped by a rebound in production, evolving price dynamics, and changing consumer preferences. For food sourcing professionals, staying ahead of these trends is essential for informed procurement and strategic planning.

Production Recovery and Supply Outlook

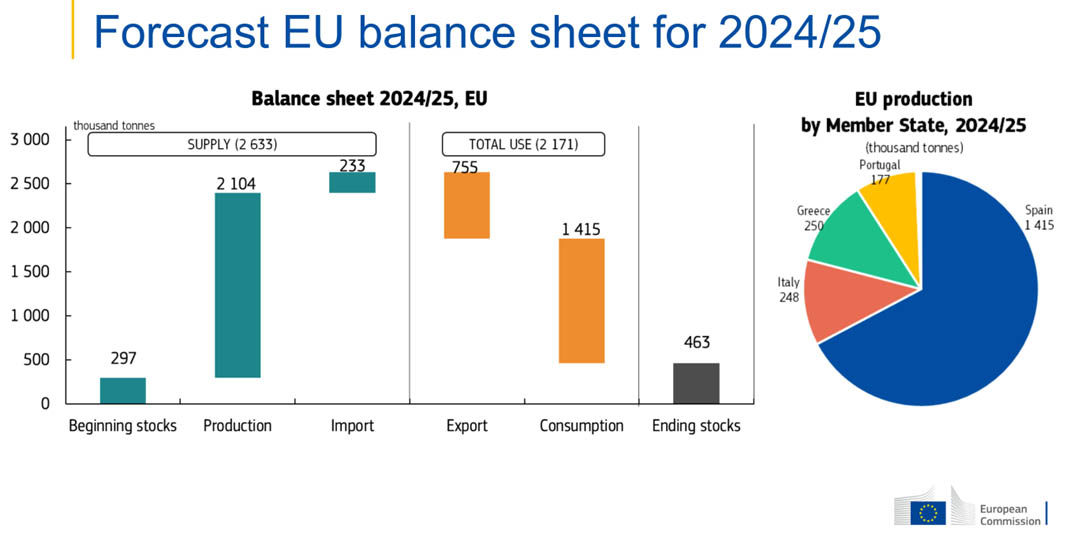

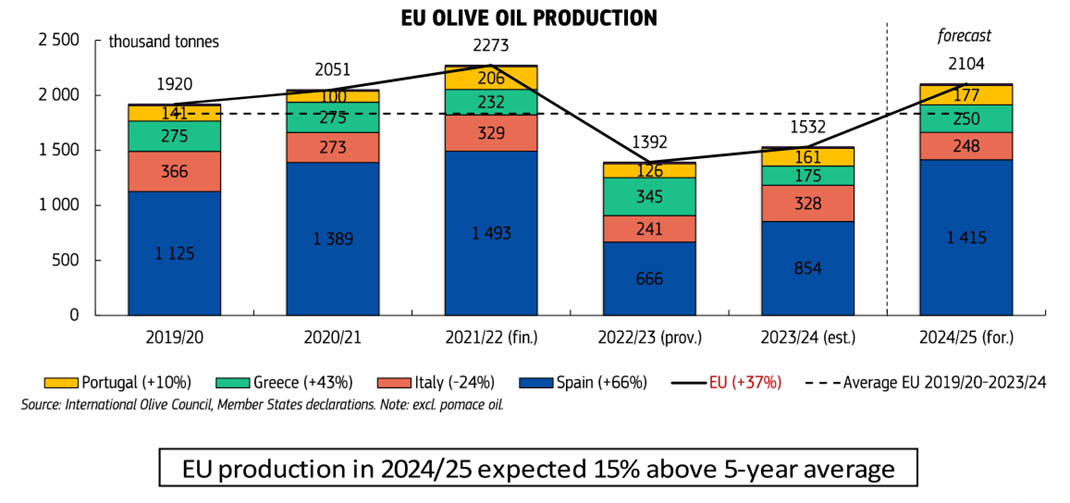

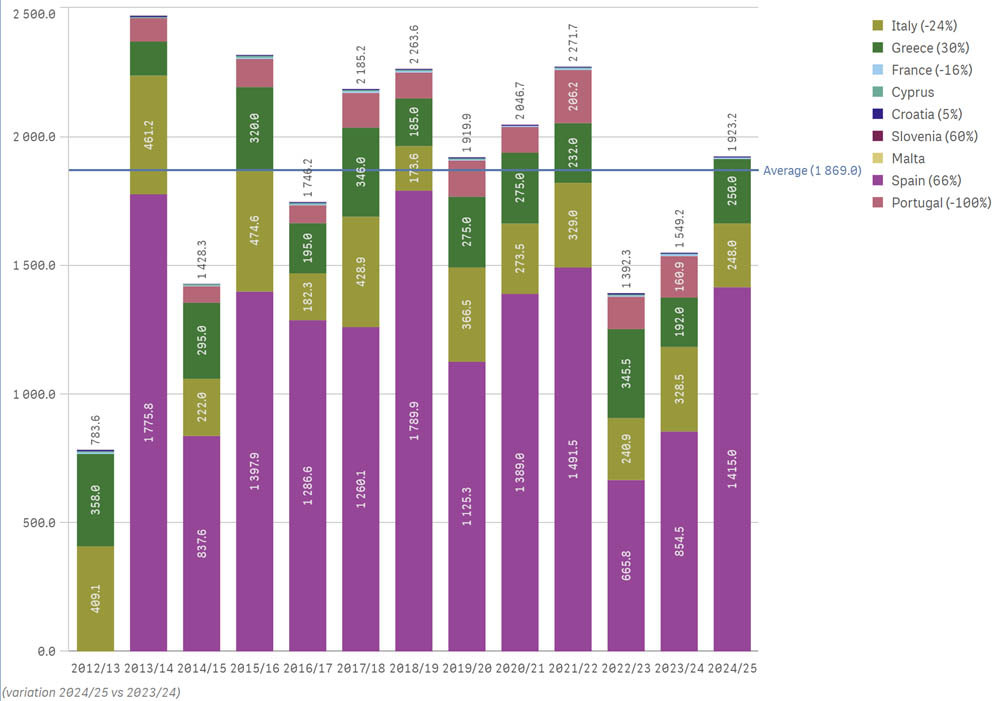

Following successive years of drought-related declines, olive oil production in Europe is expected to recover significantly. According to the European Commission, EU production for the 2024/2025 season is projected to rise by 31%, reaching 2 million metric tons—9% above the five-year average. Spain, the region’s top producer, is forecasted to achieve a 48% increase in output, reaching 1.26 million tons, thanks to favorable spring rainfall.

This recovery is expected to ease previous supply constraints and stabilize the market. Greece and Portugal are also contributing to the rebound, though Italy may face a less favorable harvest.

Weather conditions remain a critical variable. While improved conditions in 2025 are encouraging, the risk of extreme weather—such as sudden frosts, heatwaves, or droughts—continues to threaten production. Therefore, buyers must closely monitor both climate trends and geopolitical factors that could disrupt the supply chain.

Technological innovation is also playing a growing role in safeguarding yields. European producers are increasingly adopting advanced irrigation systems, precision agriculture, and drought-resistant olive tree varieties—efforts aimed at enhancing resilience and long-term sustainability.

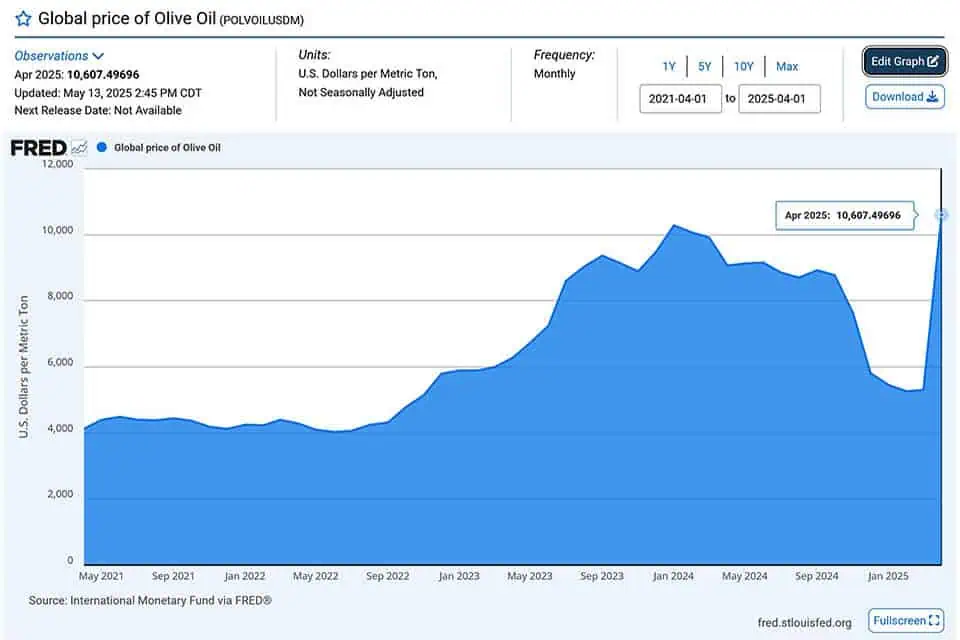

Price Shifts and Market Stabilization

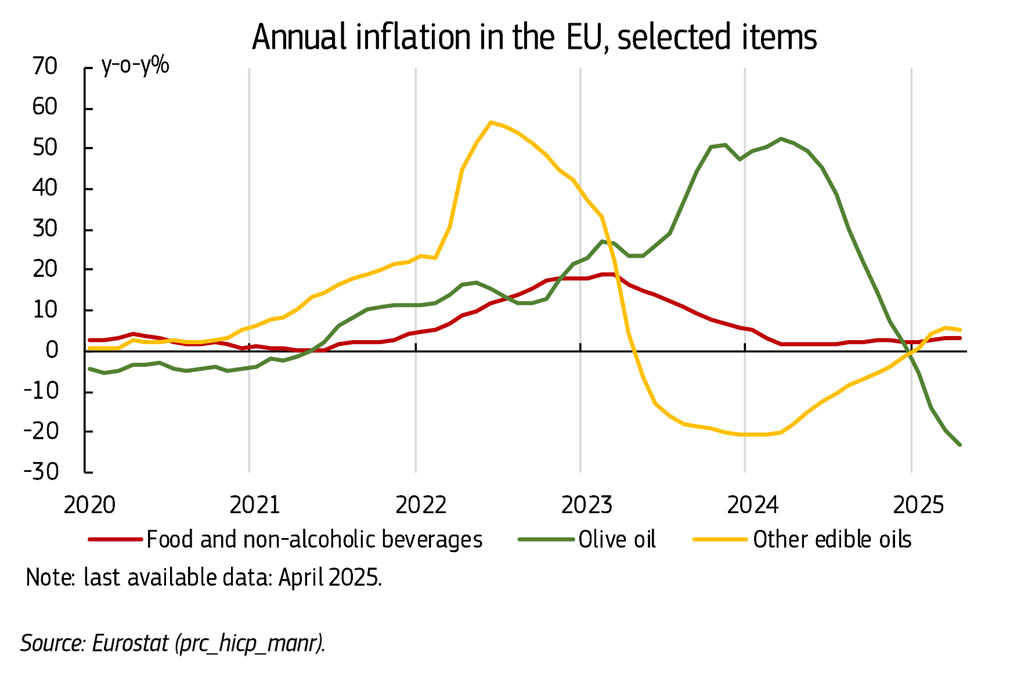

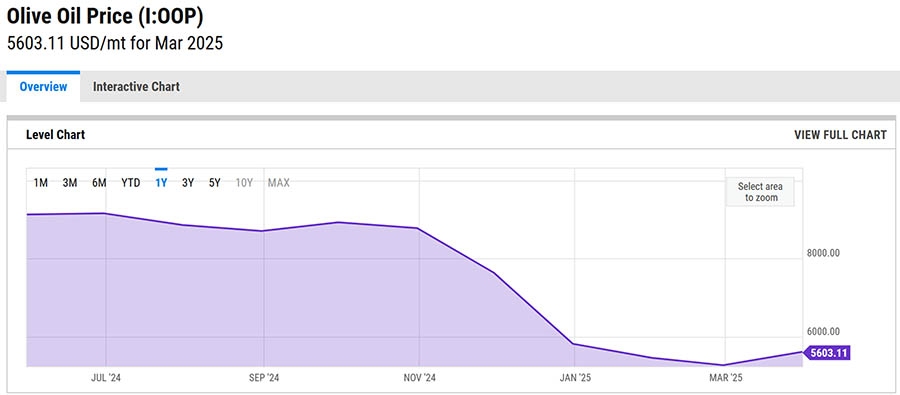

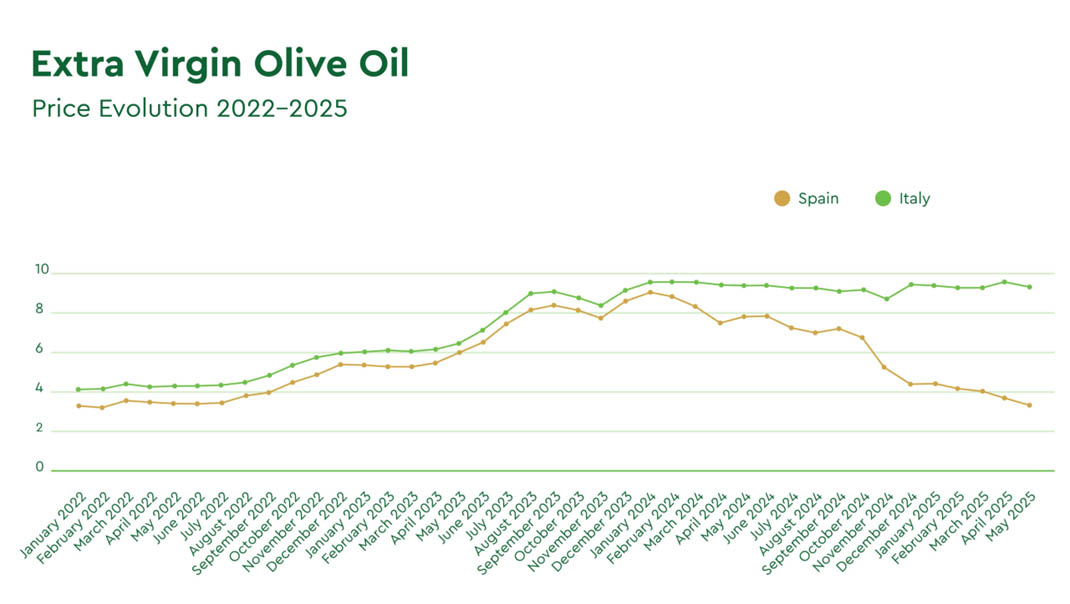

Improved harvests are poised to influence olive oil pricing. After record-high prices caused by shortages, a downward trend is expected. Deoleo, the world’s leading olive oil producer, anticipates prices could drop to around €5 per liter by early 2025, assuming favorable weather continues.

This price correction is likely to spark renewed interest among consumers, many of whom had turned to alternative oils due to high costs. The European Commission estimates a 7% rise in olive oil consumption across the EU in 2024/2025, following a 22% decline over the past two years.

Still, a sharp price drop may be tempered by broader inflation, increased production costs, and higher transport expenses. Retailers and distributors may also adjust pricing based on consumer trends and inventory strategies. Additionally, international competition is a factor: countries like Turkey and Tunisia are expanding production, offering more competitive pricing. If EU prices remain elevated, imports from these regions could rise, exerting further pressure on European producers.

Consumer Preferences and Evolving Demand

As prices begin to normalize, consumer behavior is expected to shift accordingly. During the recent price spikes, many households switched to cheaper alternatives like sunflower oil. With greater price stability, a gradual return to olive oil—particularly extra virgin—is anticipated.

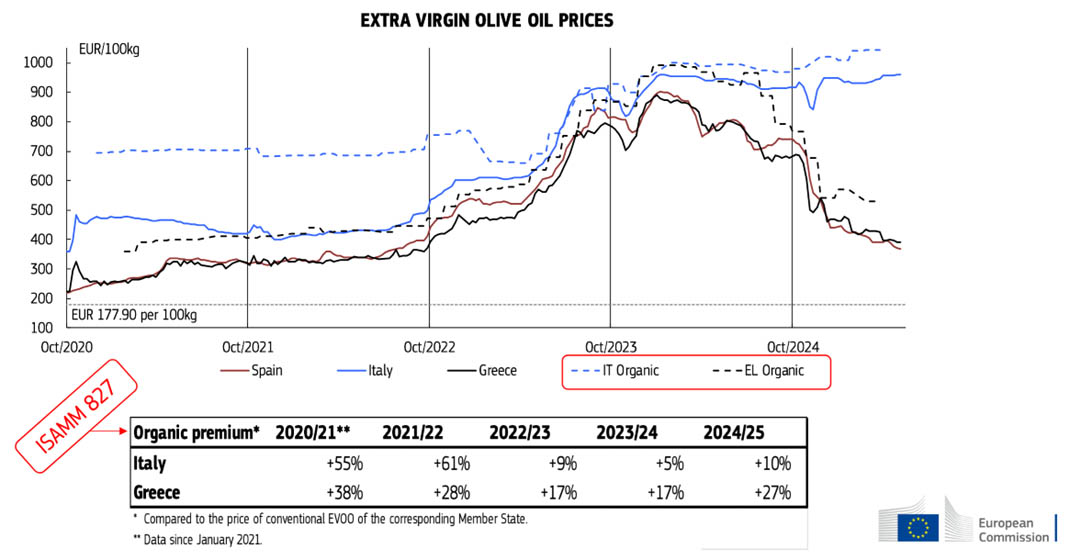

There is also growing demand for premium and sustainably produced olive oils, especially among health-conscious consumers in Western Europe. Quality, organic certification, and ethical sourcing are becoming key purchasing drivers.

Private-label olive oils are gaining popularity as supermarkets invest in their own branded offerings, combining affordability with quality. This trend not only benefits consumers but also intensifies competition with established brands.

Meanwhile, the rise of digital retail is reshaping purchasing habits. E-commerce and direct-to-consumer models are gaining traction, allowing smaller producers to reach wider audiences. Subscription services and specialized online shops for premium EVOO are also on the rise, underlining the importance of digital branding and storytelling.

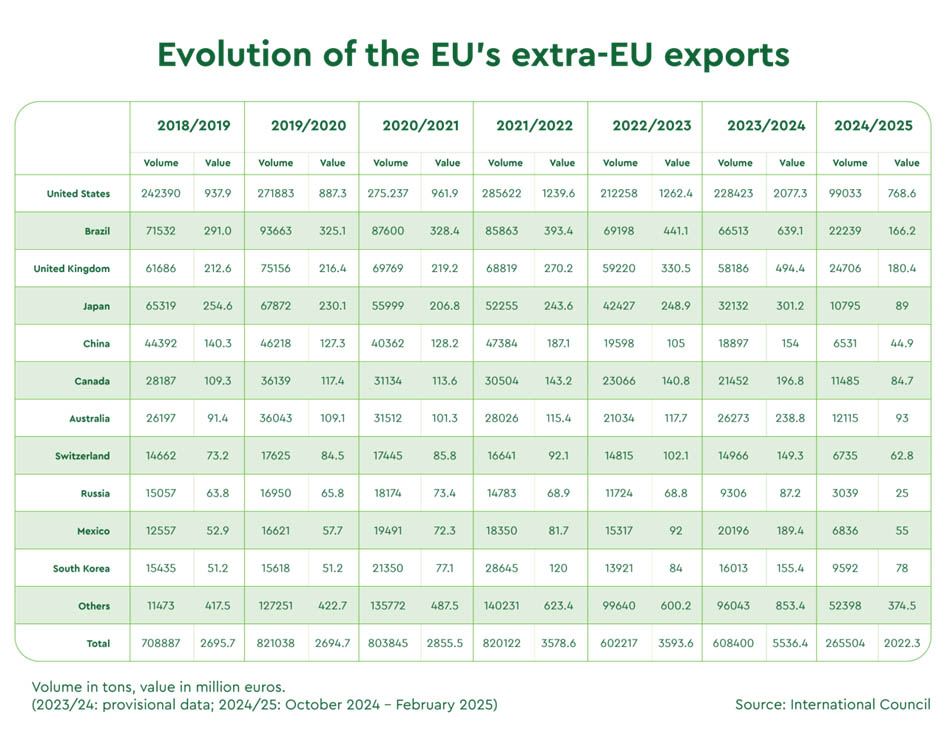

Trade Outlook and Export Potential

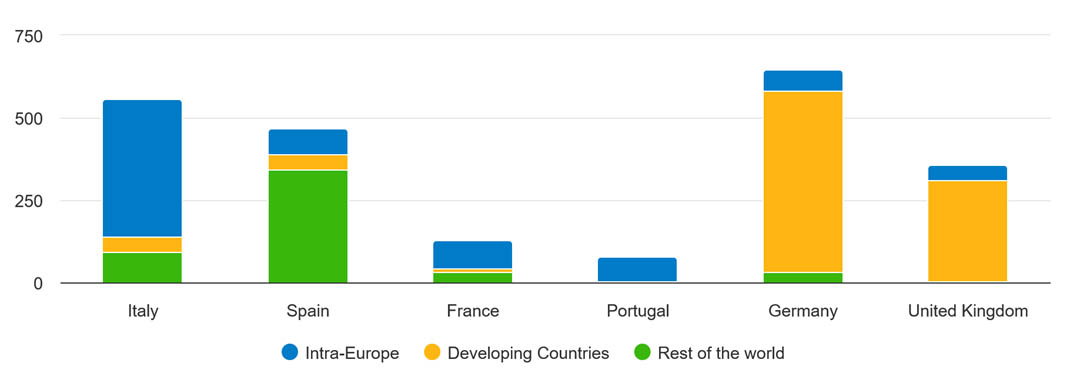

The EU’s olive oil exports are projected to grow by 10%, driven by increased output and competitive pricing. At the same time, imports are expected to decline by 7%. However, strong harvests in non-EU countries like Tunisia and Turkey could increase global competition, potentially influencing EU pricing and trade strategies.

Demand from markets outside Europe—particularly North America and Asia—is on the rise. In the U.S., Mediterranean diets are becoming more popular, fueling olive oil consumption. This presents new export opportunities, especially for premium, traceable EVOO products.

Certifications like PDO (Protected Designation of Origin) and PGI (Protected Geographical Indication) remain vital for market differentiation and consumer trust. To stay competitive globally, European producers must continue investing in traceability and transparent supply chains.

Geopolitical factors will also shape trade flows. Exporters should closely monitor developments in trade agreements, tariffs, and regulatory changes, particularly in the U.S. and UK, as these may impact pricing and logistics strategies.

Conclusion

The European olive oil market in 2025 is on track for a period of recovery and realignment. A strong production rebound—especially from Spain—is expected to stabilize supply and encourage a return to traditional consumption levels. However, the sector still faces considerable challenges, including climate unpredictability, rising operational costs, and global market competition. Success will depend on the industry’s ability to adapt, innovate, and stay ahead of shifting consumer and trade dynamics.

|

|

Olive Oil Market Overview – January 2025 Figures

According to the European Commission’s latest olive oil market balance report for the 2024/25 campaign (reflecting January data), average olive oil producers’ prices for extra virgin olive oil (EVOO) in Italy were more than double those recorded in Spain.

Extra Virgin, Virgin, and Lampante Olive Oil

In January, extra virgin olive oil (with a maximum acidity of 0,8%) was priced in Spain at an average of €440,20 per 100 kg, reflecting a 10% drop from December and a sharp 51% decline compared to January 2024. In contrast, Italian EVOO averaged €944,50 per 100 kg, showing a slight 1% monthly increase and a modest 1% year-on-year decrease. Greek EVOO stood at €468.5 per 100 kg, down 6% from the previous month and 47% lower than the same time last year.

For virgin olive oil (maximum acidity of 2%), Spain reported an average price of €399 per 100 kg in January—11% below December levels and 52% lower year-on-year. In Italy, virgin olive oil fetched €644.8 per 100 kg, up 7% monthly but down 24% annually. Greece recorded an average of €366,70 per 100 kg, down 11% from December and 50% from January 2024.

In the lampante category (olive oil with acidity above 2%, typically refined before consumption), Spain’s average price was €359,90 per 100 kg in January, reflecting a 13% monthly drop and a 56% decrease year-over-year. Italy followed with €324,30 per 100 kg, down 10% from December and 54% from a year earlier. Greece recorded the lowest price in this category at €295 per 100 kg, with a marginal 1% monthly drop and a 46% annual decline.

In Tunisia—a major non-EU producer—average prices in the third week of January were €378 per 100 kg for extra virgin olive oil (a 52% annual decline) and €295 per 100 kg for virgin olive oil (down 56,80% year-on-year).

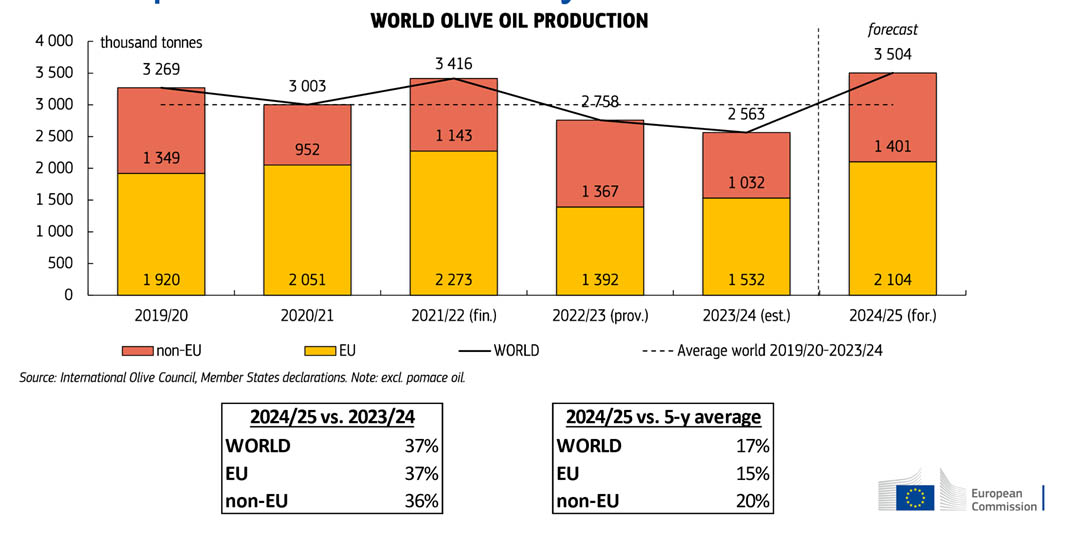

Global Olive Oil Production Forecast

The European Commission’s latest forecast places global olive oil production for the 2024/25 season at 3,39 million metric tons. Of this, around 1,99 million tons (58,70%) are expected to come from EU member states, with the remaining 1,4 million tons (41,30%) from non-EU countries.

Spain is projected to lead EU output with 1,29 million tons—an increase of 51% compared to the previous season. Greece is forecast to produce 250.000 tons (+43%), once again surpassing Italy, which is expected to yield just 240.000 tons (a 27% decline). Portugal is set to produce approximately 195.000 tons (+21%), while other EU producers (including France, Croatia, Slovenia, and Cyprus) are expected to contribute around 14.000 tons collectively.

SOURCE: OlivoNews.it

Olive Oil production (based on production by 1.000 tones for years 2009-2024 (SCOURCE: European Union)

The European market potential for olive oil: Leading Importers of Extra Virgin Olive Oil in Europe (2022 figures)

Other Articles Related to EVOO Prices in 2025:

ЦРИТИДА БИО КРЕТСКО МАСЛИНОВО УЉЕ - Произвођачи врхунских критских кулинарских производа: Наши прехрамбени производи се ИЗВОЗЕ ШИРОМ СВЕТА у 40+ земаља, од 1998. - Придружите нам се!

Ми смо вековима дуга породична компанија (1912) која се бави производњом ЕВОО маслиновог уља на острву КРИТ у ГРЧКОЈ. Наше врхунско критско екстра девичанско маслиново уље и кулинарски прехрамбени производи извозе се у више од 40 земаља широм света кроз пажљиво одабрану мрежу партнера. КОНТАКТИРАЈТЕ НАС, БУДИТЕ НАШ СЛЕДЕЋИ ПОСЛОВНИ ПАРТНЕР! за екстра дјевичанско маслиново уље (ЕВОО) - органско (био) екстра дјевичанско маслиново уље (органско ЕВОО) - грчке столне маслине - балзамико сирће - деликатесе, све са КРИТА ГРЧКА

Повезани постови

Цритида Био Критско маслиново уље на ФООДЕКСПО Грееце 2023

Наша компанија ЦРИТИДА БИО КРЕТАН ОЛИВЕ ОИЛ учествоваће на „Фоодекпо Грееце 2023”

Цритида Био Цретан маслиново уље на сајму Фоод Екпо Атхенс Грееце 2022

Цритида Био Цретан Оливе Оил учествоваће на сајму Атхенс Фоод Екпо Грееце 2022.

Зашто је Грчка реч када је у питању маслиново уље – грчки је најбољи ЕВОО на свету

Како доћи до грчког: Зашто је Грчка реч када је у питању маслиново уље (ИЗВОР: Тхе Индепендент УК

Како користити маслиново уље за негу косе – предности

Употреба маслиновог уља за негу косе Маслиново уље за негу косе: Како користити и могуће користи Маслиново уље и